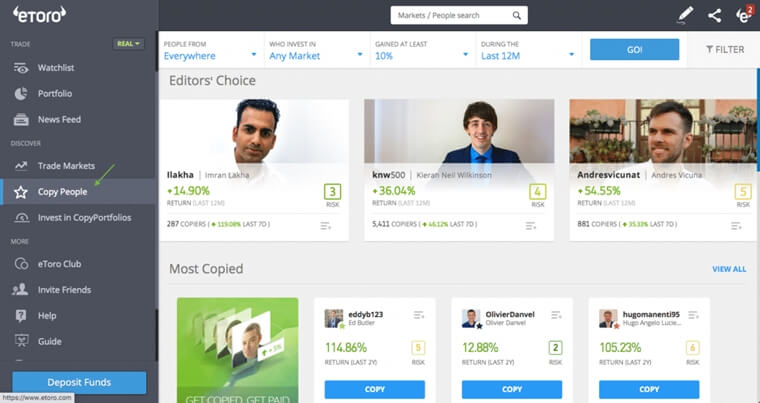

What is Copytrade eToro? Copy Trading: Trade like eToro’s top traders. eToro’s most popular feature, allows you to view what real traders are doing in real-time and copy their trading automatically.

EToro’s award-winning CopyTrader technology is a game-changer in the industry, enabling anyone to trade like a top trader.

Also read: What is Spread Broker?

When they trade, you trade

Whether you’re a beginner learning the basics or you simply don’t have time to watch the markets, now it’s easy to leverage other traders’ expertise.

Also read: What is a Forex Broker?

With eToro’s CopyTrader, you can automatically copy top-performing traders, instantly replicating their trading in your own portfolio.

Top traders work for you without management fees

Sign up for eToro and start copying other traders at no extra charge. There are no management fees or other hidden costs involved. View our complete pricing policy here.

Also read: Types of Forex Brokers: DD, NDD, Hybrid, ECN, or Elite?

The traders you copy get paid directly as part of our Popular Investor Program. To learn more about earning income by being copied on eToro, click here.

Not just a copy trading platform, but a community

For those looking to improve their trading, eToro offers so much more than just a copy trading platform. You’ll be joining a leading collaborative community of traders and investors a place to connect, share, and learn.

Also read: How to Create FXTM Demo Account for Beginner

View millions of other traders’ portfolios, stats, risk scores, and more. Chat with them, discuss strategies and benefit from their knowledge.

eToro is only as GOOD As our clients say WE ARE

Also read: How to Create Exness Demo Account for Beginner

How To Copy Trade eToro

CopyTrader is so simple and user-friendly. Once you’ve spotted a trader you like, just click and let the copy trading begin.

Also read: How To Create OctaFX Demo Account for Beginner

How to copy traders on eToro:

- Choose a trader: Search for traders by performance, assets, risk score, and more

- Set an amount: Choose a total amount for the copy the proportions are calculated automatically

- Click Copy: Click the “Copy” button to start automatically copying the trader’s positions

Also read: How To Create XM Demo Account for Beginner

You’re in control

When you use CopyTrader, you still retain full control over managing your portfolio. Choose one trader to copy or up to 100 simultaneously.

You can stop the copy, pause it, and add or remove funds at any time. For more details on how to copy trading works.

Also read: How To Create FBS Demo Account For Beginner

Take it for a test drive

Want to try CopyTrader without risking any capital? Try it in demo mode. Every eToro account includes a free $100,000 virtual portfolio for you to practice with.

Also read: How To Create InstaForex Demo Account For Beginner

Copytrade eToro, How To?

CopyTrader is eToro’s most iconic feature.

The driving force of social trading, CopyTrader enables you to see what real people are trading in real-time, find and follow the traders you like, and, of course, copy their trading activity with just a few clicks.

Also read: 3 Forex Trading Mindsets That Influence To Be Successful Trader

EToro’s CopyTrader system is a game-changer in the industry as it enables traders to build a real people-based portfolio.

Here are some minimums and maximums to keep in mind;

- $200 is the minimum amount required to invest in a trader.

- 100 is the maximum amount of traders you can copy simultaneously.

- The maximum amount you can invest in a trader is $2,000,000.

- The minimum trade size is $1 – if the proportional amount in the copier’s account is under $1, the trade will not open.

A few things to remember:

- You can copy other traders in your virtual portfolio.

- Only real portfolios can be copied.

Also read: What is Forex Money Management For Beginner Trader?

Copytrade eToro Systems Explained

EToro’s social features are what make our platform unique in the online trading space.

Both the CopyTrader system and CopyPortfolios investment strategies lean on eToro’s user-base, which numbers over 20 million users from 140 countries, and are designed to help traders explore new ways to generate profit.

Also read: 8 How to Read Forex Factory Calendar Precisely and Accurately

How Does CopyTrader Work?

The CopyTrader system is one of the key reasons the platform is considered among the leaders of the fintech revolution.

The general idea of the CopyTrader tool is pretty simple: Choose the traders you want to copy, decide on the amount you wish to invest, and copy everything they do automatically, and in real-time, with one click of a button.

Also read: What is A Forex Trading for Beginners Traders

Beyond the basic concept of copy trading, there are quite a few additional elements to the system. Before we begin, we will refer to;

- “Copied Trader” as the trader you are investing in (copying)

- “Copier” as the user who is doing the copy action (i.e. yourself)

Here are a few important points you should take into consideration before copying;

- The minimum amount to invest in a trader is $200

- The maximum amount of traders you can copy simultaneously is 100

- The maximum amount you can invest in one trader is $2,000,000

- The minimum amount for a copied trade is $1; trades below this amount will not be opened

- If you close a copied trade manually, the funds from this position will be credited back to your copy balance (the amount allocated to copy that person that is not invested in open positions).

Also read: 4 Knowledge and Aspects of Forex Psychology

CopyTrader: Copying All Trades

The CopyTrader system gives copiers the option to copy all of the currently open trades of the copied trader.

Copiers choosing this method will have the existing open trades of the trader they are copying opened, with the following terms;

- The existing open positions will be opened in the copier’s account with the market rates available at the time of copying (not the rates at which the original trades were opened).

- The trades will have the same stop loss (SL) and take profit (TP) as the original trade.

- They will mirror the Copied Trader’s future actions including changes in SL’s and TP and closing of the trade, from the moment you begin copying them. If the copied trader extends their SL by adding more funds to a position, your SL will adjust accordingly. However, your position amount will stay the same as its initial amount. Therefore, you may sometimes see differences in gain percentage between your copy account and the copied trader’s account.

- You will be able to close a specific copied trade without closing the copy account.

- If the Copied Trader opens a position in markets that are closed during the time they are copied (market break for example), the system will open a Market Order for the copier. Once the market is open, the order will execute into a position with the first market rate.

- To see all of the trades copied from a single trader, go to your portfolio and click the Copied Trader’s name.

Please note: The trades will all open in your account at the same time. You will see them at a slight loss which reflects the spread between the Buy and Sells rates, to show you a real-time representation of the funds you will receive if you close the trade.

Also read: How to Learn Forex Trading from Zero for Beginners Trader

New trades will open at the same rates as the copied trader opens them, and use the Realised equity (balance + invested funds) as the basis for the proportions of copied trades.

For example, a trade opened with 10% of the Copied Trader’s realized equity will open a trade-in your copy account with 10% of the realized equity in the copy relationship.

Also read: 5 Components of How to Become a Professional Forex Trader

However the proportion can change when the copied trader changes their available balance – this can occur when the Copied Trader makes a deposit or withdrawal.

When any of these events occur, there is a change in funds in the Copied Trader’s account, and you might notice trades that have a different proportion than before.

Also read: Forex Price Movements: Pivot Points, Support and Resistance

When the Copied Trader closes all open trades, the trade size proportions between their account and the copier’s account are reset (equal once more).

**These terms and conditions are subject to change at Copytrade eToro discretion, at any time.

Most searched keywords:

- best forex broker

- oanda eur usd

- forex paypal

- mt5 futures broker

- cfd forex brokers

- forex etoro

- fx pro ctrader

- copytrade etoro

- trade forex

- spread broker

- etoro trustpilot

- etoro mt5

- mt4 etoro

- etoro paypal

- etoro apple

- broker etoro

- trade etoro

- etoro google play

- etoro visa card

- interactive broker eu

- gold etoro

- broker ibkr

- broker futures trading

- broker saxo