Forex technical analysis is a way of analyzing asset price movements in financial markets using statistical tools such as graphs and mathematical formulas.

The purpose of studying technical analysis is so that traders can assess current market conditions based on price history in the past, as well as provide an overview or prediction about future market movements.

Also read: How to Learn Forex Trading from Zero for Beginners Trader

In the past, traders performed calculations that combined charts and mathematical formulas manually, but now technical analysis can be done more easily.

Generally, online trading platforms are equipped with features to display price movements in various types of charts, as well as various technical indicators as analytical tools.

Also read: List of Scam Forex Brokers in Indonesia According to BAPPEBTI Regulators

Basic Principles of Technical Analysis

Technical analysis is one of the two most common types of forex analysis used by traders.

Also read: 5 Best Forex Trading Hours in Indonesia and Worldwide

Another type of analysis is a fundamental analysis which attempts to analyze the value of a currency based on the economic conditions of the country of origin, the financial market situation, or other news and rumors circulating.

Unlike fundamental analysis, technical analysis is based on three principles:

1. Market Price Discount Everything

The price is seen on the chart (chart) has described all the factors that affect the market.

Also read: 8 How to Read Forex Factory Calendar Precisely and Accurately

2. Price Moves in Trend

The price does not move randomly, but always forms a certain pattern (trend) which will continue until there are signs that this movement pattern stops and changes.

3. History Repeats Itself

There is a strong tendency that the behavior of market participants today will react in the same way as market participants in the past, in responding to various information affecting the market.

So that the motive of the movement that had happened before, can be repeated again.

Also read: Know More About What is A Forex Trading for Beginners Traders

Components of Forex Technical Analysis

Technical analysis contains a number of important components. These components must be known by all forex traders.

1. Price Chart

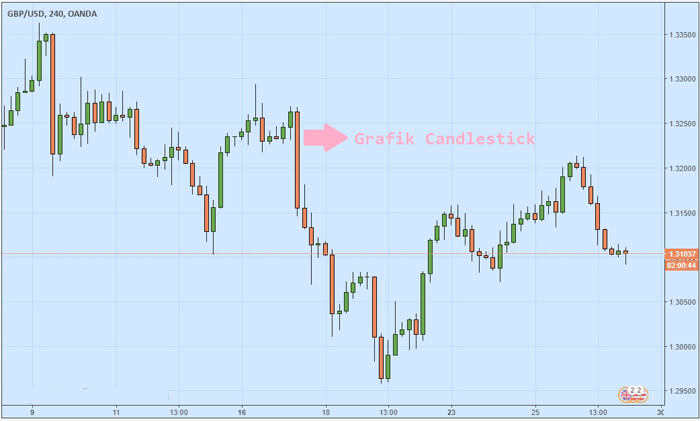

The price chart shows the exchange rates of two currencies and keeps moving from time to time. There are three price chart models that are commonly used in technical analysis, namely line charts, bar charts, and candlestick charts.

Among the three, the most popular in Indonesia is the Candlestick chart as shown in the GBP/USD (Pounds/US Dollar) price movement picture above.

Also read: 5 Components of How to Become a Professional Forex Trader

2. Technical Indicators

In order for the price movement shown by the chart above to be analyzed, technical indicators are needed.

There are many types of technical indicators, but they all have one thing in common, namely that they allow traders to interpret current price movements so that they can generate predictions for future price movements.

Also read: What is Forex Money Management For Beginner Trader?

Due to a large number of technical indicators in the world, even up to hundreds, each trader can use different indicators.

However, there are a number of indicators that are commonly used, including the Moving Average (MA) and the Relative Strength Index (RSI).

For example, in the image below, the GBP/USD chart has technical indicators in the form of MA and RSI.

Also read: 3 Forex Trading Mindsets That Influence To Be Successful Trader

From the condition of these technical indicators, it can be understood that the price on GBP/USD is bearish (a declining price trend) and traders have an opportunity to ‘Sell’.

How can you conclude that? Because the price movement is below the MA line; While the RSI is declining, but has not yet reached the 30.0 points.

Later, if the RSI has reached 30.0, then it may be the moment to ‘Buy’ GBP/USD because it marks a change in movement in the market.

Also read: Learn About How to Read Forex Chart Patterns for Beginners Traders

Learning technical analysis means having to understand how to use indicators such as the Moving Average and the RSI. However, technical analysis and indicators are not 100% certain.

Market conditions can change at any time and no one in the world can know what will happen in the future. Therefore, the results of both technical analysis and fundamental analysis are ‘estimates’, and traders must always be prepared to face the possibility of wrong predictions.

Also read: Forex Price Movements: Pivot Points, Support and Resistance

3. Techniques or Technical Analysis Methods

The combination of MA and RSI to formulate forex trading decisions as in the example above, is part of the technique or method of technical analysis. So, in technical analysis, just having charts and indicators alone is not enough.

Forex traders can create their own analysis techniques or methods, based on one type of indicator, a combination of many indicators, or combined with special techniques such as Fibonacci, Retracement and Reversal, Elliott Wave, and so on.

Also read: What is Forex Trendline Analysis

Difference between Technical Analysis and Fundamental Analysis

As the foundation of forex analysis, technical and fundamental have different characteristics.

Fundamental analysis characteristics;

- It takes time to obtain information such as the latest economic data or rumors. Individual traders find it difficult to get this kind of info.

- It is subjective because it involves the opinions of many people. A trader may think certain economic data is good, but other traders think it is bad.

- It is more suitable to be applied for the medium-long term.

Technical analysis characteristics;

- Requires a lot of data to support prediction accuracy.

- Its reliability depends on the trader’s ability to read charts, apply indicators, and practice analytical techniques.

- Suitable for short-term and long-term trading.

The existence of two types of forex analysis, namely technical analysis and fundamental analysis, often raises the question of which of the two is better.

In fact, these two types of forex analysis have their own characteristics and should be used together proportionally, not just one or the other.