The way of forex analysis is generally divided into two, namely fundamental analysis and technical analysis. There are also those who add sentiment analysis and Intermarket analysis as a compliment.

Most traders combine several ways of forex analysis to get a more complete picture of market conditions, but there are traders who focus on just one of them.

Also read: Learn Forex Technical Analysis

Beginner traders need to learn various ways of forex analysis and the different characteristics of each, before starting real trading.

After that, know what to pay attention to when doing forex analysis in order to reach the right conclusions and support you in your efforts to make profits.

Also read: How to Learn Forex Trading from Zero for Beginners Trader

Various Ways of Forex Analysis

Also read: List of Scam Forex Brokers in Indonesia According to BAPPEBTI Regulators

1. Fundamental Analysis

Fundamental analysis is a way of forex analysis by examining price movements based on economic data and news that is being discussed in the financial markets.

Traders using fundamental analysis will observe economic data that influences market players’ decision-making, such as inflation, interest rates, Gross Domestic Product (GDP), unemployment, and so on.

In addition, news related to political stability and security is also often highlighted to conclude whether a country’s economy is healthy or not.

Also read: 5 Best Forex Trading Hours in Indonesia and Worldwide

For example, a trader who studies the fundamentals of the EUR/USD currency pair finds that the economic conditions of the United States are better than those of the Eurozone.

He knew that projected higher economic growth could encourage investors to invest more in the United States. In this situation, he could decide to buy USD against EUR (sell EUR/USD).

2. Technical Analysis

Technical analysis is a way of forex analysis by measuring price changes using statistical tools such as charts and mathematical formulas. The application of technical analysis requires price charts (charts) and indicators that are reviewed with certain methods.

Also read: 8 How to Read Forex Factory Calendar Precisely and Accurately

In the past, traders needed to draw charts and perform technical analysis calculations manually.

However, now the charts and technical indicators needed are integrated with the online forex trading platform, making it easier. Traders only need to understand technical analysis methods (how to read charts and indicators).

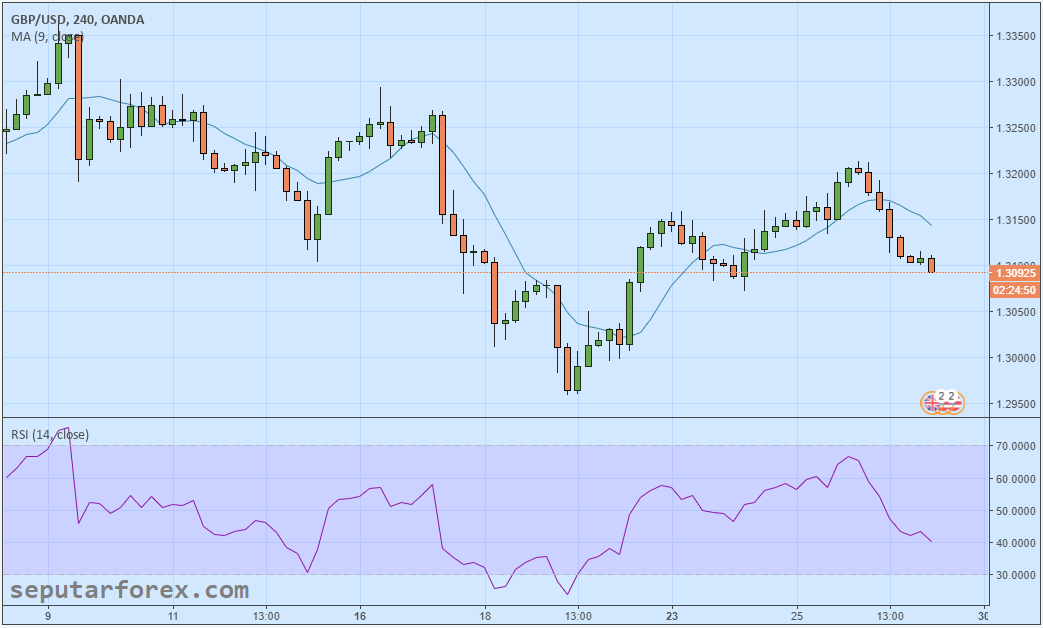

For example, a trader who analyzes the GBP/USD currency pair will look at the price chart, then apply technical indicators as shown below:

From this view, traders will conclude that the price on GBP/USD is bearish (a declining price trend) and traders have an opportunity to sell.

How can you conclude that? Because traders already know how to interpret the Moving Average and the RSI indicator that is applied to the price chart.

In addition to fundamentals and technicals, some traders also study other branches of forex analysis: sentiment analysis and Intermarket analysis. However, traders generally only use it as a support for fundamental and technical analysis.

Also read: Know More About What is A Forex Trading for Beginners Traders

3. Sentiment Analysis

Sentiment analysis is a way of forex analysis by observing the collective agreement (consensus) of market participants to anticipate price movements.

In general, there are four sentiments that can arise in financial markets, namely bullish sentiment, bearish sentiment, high-risk appetite, and risk avoidance.

Also read: 5 Components of How to Become a Professional Forex Trader

4. Intermarket Analysis

Intermarket analysis is a way of forex analysis by examining the relationships and interactions between the four main groups of financial assets, namely stocks, bonds, commodities, and currencies (forex).

For example, it is known that there is a positive correlation between the stock index and the exchange rate of a country’s currency.

Also read: What is Forex Money Management For Beginner Trader?

Based on this knowledge, the strengthening of the Nikkei index (Japanese stock exchange) can have a bullish effect on the Yen, so traders expect the USD/JPY to decline.

Forex Analysis Principles

Also read: 3 Forex Trading Mindsets That Influence To Be Successful Trader

1. Understanding the Factors That Drive the Market

One of the keys to successful trading is understanding why a movement occurs in the market. So, for example, when you see a price drop, investigate why it is falling.

The driving factors can come from fundamental, technical, market sentiment, and Intermarket aspects. It is also important to understand that;

- The factors that drive the market at any one time are always various; There is no price movement that is only driven by one reason.

- The influence of these factors will continue to change from time to time.

For example, last week the US Dollar slumped against the Euro as the US unemployment rate was reported to have risen and there was no indication that interest rates would rise;

While the Eurozone managed to record good economic growth. However, this week the US dollar strengthened again. What’s wrong?

Also read: Learn About How to Read Forex Chart Patterns for Beginners Traders

By listening to forex news, traders may find that inflation data is rising thus supporting interest rate hikes in the near future. From the Euro side, there may not be any change in conditions, but there could also be bad news.

Another example, the US stock index continues to increase as a result of good economic conditions. However, one time suddenly the US stock index fell. Does that mean economic conditions are deteriorating? Not necessarily. Maybe there are technical factors.

Also read: Forex Price Movements: Pivot Points, Support and Resistance

For example, the price has reached a certain psychological level that becomes a benchmark for investors to judge the stock has gone too high, so a sell-off in the context of profit-taking begins.

Because market-moving factors can change, traders are advised not to just focus on the current price chart, but also the price chart on a larger timeframe.

For example, even though you will be trading the NZD/USD currency pair on the H1 timeframe, it is also worth looking at the dynamics on the H4 and Daily timeframes.

Also read: What is Forex Trendline Analysis

2. Knowing the Market Consensus

After understanding what factors move the market, the next step is to find out the general view of market participants (consensus).

It’s best not to force your own translation; Because it is not your trading decisions that control the market, but the countless number of buyers and sellers.

How to find out the market consensus? Every way of forex analysis has covered this discussion.

In fundamental analysis, it is usually seen from the projection of a country’s economic-political-security health at a time when compared to the previous period. In technical analysis, traders can see the strength of the buyer-seller (supply-demand) on the price chart.

3. Concluding Whether The Market Conditions Are Suitable For Trading

Forex analysis does not stop only by investigating the driving factors and market consensus but is expected to produce a conclusion for traders about whether to trade or not.

If it is decided to trade, it must also be decided where or when the trader will enter (buy/sell execution) and exit (close position) based on the trading system used.

If the market does not show potential trading opportunities or the movement does not match the trading system, then don’t force yourself to enter.

These various ways of forex analysis are the art of knowing the background (context) of price movements in the financial market. Similar to art, everyone can develop different styles and methods.

Even if you study with the same person, the results are not necessarily the same. Your forex analysis method is not necessarily the same as your own teacher.

However, one thing is certain for novice traders: you need to know how to do each type of forex analysis before you start trading.

If you do not understand the specific terms in forex on this page such as bearish, bullish, and close positions, you can visit the Forex Dictionary. Take advantage of Forex Dictionary when you encounter new vocabulary for optimal understanding.